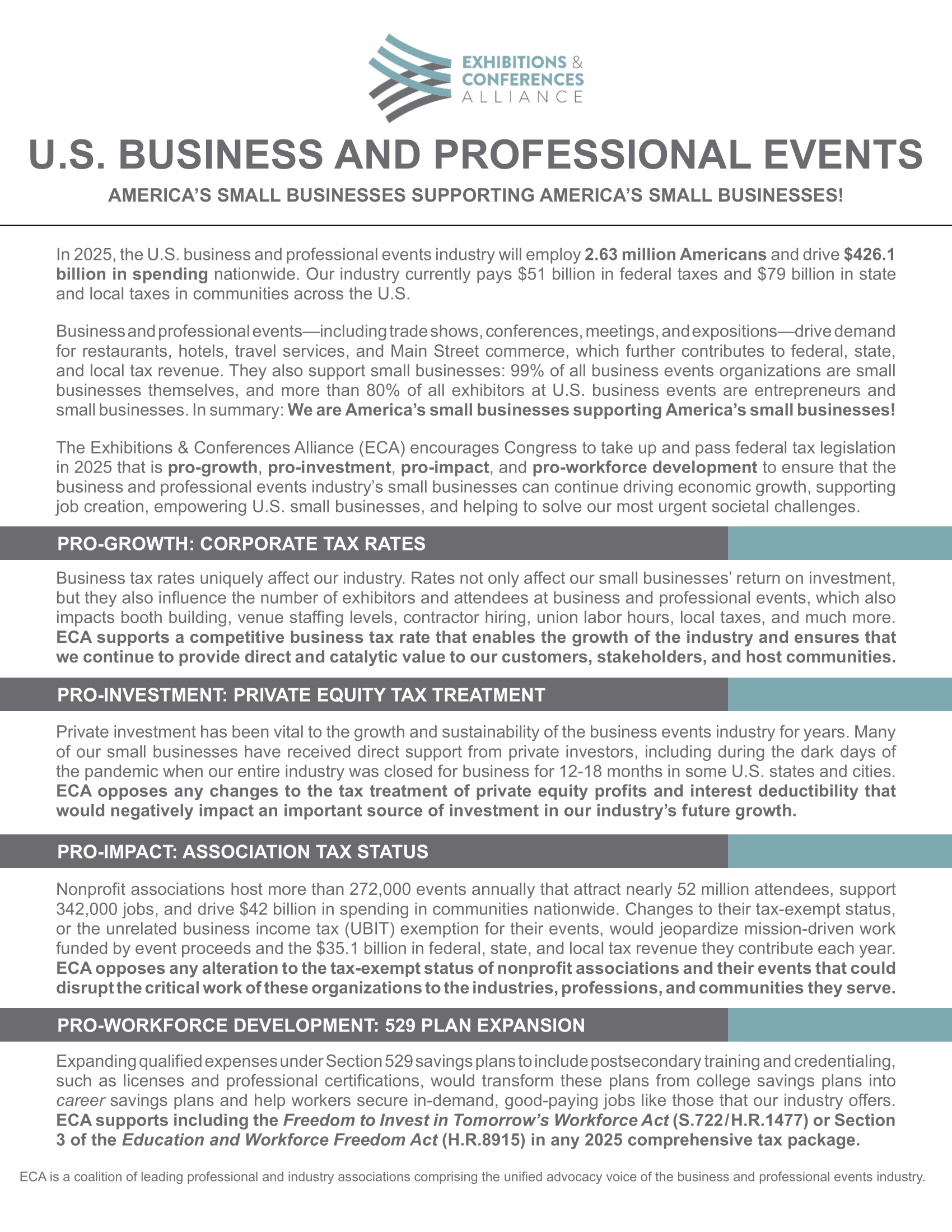

ECA encourages Congress to take up and pass federal tax reform legislation in 2025 that is pro-growth, pro-investment, pro-impact, and pro-workforce development to ensure that our industry’s small businesses and entrepreneurs can continue driving economic growth, supporting job creation, empowering their small business customers, and helping to solve our most urgent societal challenges.

- Pro-growth: ECA supports a competitive business tax rate that enables the growth of the industry and ensures that we continue to provide direct and catalytic value to our customers, stakeholders, and host communities.

- Pro-investment: ECA opposes changes to the tax treatment of private equity profits and interest deductibility that would negatively impact an important source of investment in our industry’s small businesses and future growth.

- Pro-impact: ECA opposes any alteration to the tax-exempt status of nonprofit associations and their events that could disrupt the critical work of these organizations to the industries, professions, and communities they serve.

- Pro-workforce development: ECA supports transforming Section 529 college savings plans into career savings plans that help workers secure in-demand, good-paying jobs like those that the industry offers.

For more information on ECA's 2025 tax reform agenda, please click on the graphic below. Thank you.